| Getting your Trinity Audio player ready... |

The 13-Week Cash Flow Model Every Business Needs

Cash is the pulse of every firm. Even if your firm is producing a profit, it doesn’t mean you’re financially healthy. That’s why controlling cash flow is important for the survival and development of a business.

This is where the 13-week cash flow model enters. Whether you’re a startup or a rising service firm, this model may help you understand what’s ahead and prepare better.

Let’s get into how the 13-week cash flow model works, why it matters, and how you can develop one for your organization.

What is 13-Week Cash Flow Model Mean?

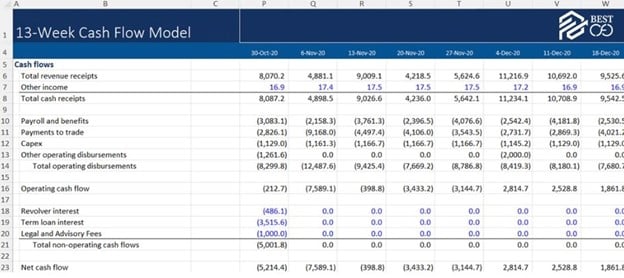

The 13-week cash flow model is a technique used by organizations to track and estimate cash flows weekly over a 3-month period. It gives clear insight into your company’s financial status and helps avoid liquidity difficulties before they emerge.

What Makes the 13-Week Forecast Special?

Unlike yearly or monthly financial forecasting, this model focuses on the near future. Here’s what make it special:

- Short-Term Goal: It gives you a clear view of the next 90 days, which is important for decision-making.

- Weekly Details: Unlike monthly plans, it tracks every week, so you can see when exactly cash shortages might occur.

- Cash Over Profit: Many firms get trapped focused exclusively on the income statement. But this approach stresses liquidity—how much real cash you have to keep operations operating.

Key Components of a 13-Week Cash Flow Model

To build a strong 13-week forecast model, you need to track:

- Cash Inflows.

- Cash Outflows

- Net Cash Position

- Adjustments

When Should You Use It?

This model isn’t just for companies in crisis. It’s useful in many situations:

- Early-stage startups with uncertain revenue

- Companies facing financial distress

- Businesses preparing for fundraising, a merger, or loan application

- Seasonal businesses managing inconsistent cash flow

Advantages of a 13-Week Cash Flow Model

Using a 13-week cash flow model gives you more control over your business and helps you stay ahead of problems. Here are benefits:

Proactive Cash Crisis Prevention

The 13-week cash flow model acts like a financial warning system. It shows you cash shortfalls before they happen

Better Decision-Making with Real-Time Data

Weekly updates provide updated insights that assist you with:

- Prioritize key payments like wages and debt

- Decide whether to defer or authorize purchases

- Make wiser investing decisions

Improved Vendor & Lender Relationships

A realistic financial projection may help you develop confidence with creditors and suppliers. It indicates that you’re organized, responsible, and looking ahead—key attributes lenders look for in company management.

Enhanced Strategic Planning

Use the model to:

- Plan when to hire or buy new equipment

- Time capital expenditures

- Align expenses with expected revenue

Stress Testing & Scenario Planning

With the 13-week cash flow model, you can run different “what-if” scenarios:

- What if sales drop 30% next month?

- What if a major client delays payment?

- What if inflation increases your material costs?

Scenario planning helps you prepare for economic uncertainty, global events like a pandemic, or sudden shifts in the market.

How to Build Your 13-Week Cash Flow Model Forecast

Building a realistic cash flow projection doesn’t have to be hard. Here’s how to set it up:

Step-by-Step Setup

- Gather Historical Data: Take bank statements, old receipts, accounts receivable, and accounts payable records.

- Project Cash Inflows: Forecast genuine sales, loan inflows, or other income streams.

- Estimate Cash Outflows: Include fixed costs like rent and salary, and variable expenses like inventory or interest payments.

- Calculate Net Weekly Cash Flow: Subtract outflows from inflows to calculate your predicted cash balance each week. Spot and correct any prospective deficiencies in advance.

Best Practices for Accuracy

- Use conservative estimates—it’s better to be surprised by extra cash than by a shortage.

- Update the forecast weekly as new data comes in.

- Run different scenarios to prepare for unexpected events.

Common Pitfalls to Avoid

- Overestimating sales collections

- Ignoring irregular expenses (taxes, maintenance, etc.)

- Not comparing actuals to projections, which can damage forecast accuracy

How to Use the 13-Week Cash Flow Model to Make Better Decisions

This model is a powerful tool for improving decisions across the organization.

Identifying Cash Shortfalls Early

By spotting shortfalls weeks in advance, you can choose to:

- Reduce costs

- Renegotiate payment terms with suppliers

- Explore borrowing base options or apply for debtor-in-possession financing

Strategic Uses for Healthy Businesses

If your business is stable, use the model to:

- Plan owner distributions

- Prepare for stakeholder or investor reviews

- Time big purchases without disrupting cash flow

Case Study Example

A small private sector logistics company was growing fast but always felt broke. After using the 13-week model, they saw a cash gap coming in Week 8. They delayed a vehicle purchase, improved their accounts receivable collection, and secured a short-term loan. The model helped them avoid a crisis—and boosted their leadership team’s confidence.

Free 13-Week Cash Flow Model & Tools

Want to build your own? Here are a few tools to get started:

- Downloadable Template: [Google Sheets / Excel Template] – customizable and free.

Automated Tools:

- Float (great for syncing with accounting software)

- Pulse (ideal for startups and consultants)

- QuickBooks Cash Flow Planner (perfect for small businesses)

You can also adjust these tools based on your industry, whether you’re in e-commerce, consulting, or technology.

Conclusion

A company isn’t simply about profits—it’s about cash. The 13-week cash flow model lets you predict what’s ahead, prevent surprises, and make wise choices. Whether you’re a founder, a financial analyst, or a chief financial officer, this model is your hidden weapon to remain ahead.

And if you need assistance putting it up, working with a Best CFO or an outsourced financial services team may save time and enhance accuracy. The ideal partner will not only assist construct your forecast but also help match it with your goals—so your company flourishes, especially during difficult times.

FAQs

1: Is the 13-week cash flow model only for struggling businesses?

No, it’s useful for all companies, from early-stage startups to large corporations. It helps with decision-making, risk management, and planning.

2: Can I build the model without an accountant?

Yes, especially with templates and tools. But if you’re unsure, a consultant or CFO can guide you.

3: What’s the difference between this model and traditional budgets?

Budgets are long-term and focus on goals. The 13-week model is short-term, focused on cash and staying liquid.

4: Is this model suitable for service industries?

Absolutely. It’s great for businesses that rely on billing cycles, payroll, and client payments.

5: How often should I update the forecast?

Weekly! That’s the power of the model—it evolves with real-time data.

Related Posts

Accounts Receivable Financing: Pros and Cons You Need to Know

How to Improve Your Bad Debt to Equity Ratio: A Complete Guide If you’ve ever…

Debt Review vs Debt Consolidation – Key Differences Explained

CFO Automation: Why Finance Leaders Can’t Afford to Ignore It “60% of all finance tasks…

Cash Flow Insights: How a Business Line of Credit Keeps You Agile

How To Prepare Annual Budget For A Company: An Ultimate Guide When it comes to…

What Are The Sections of The Statement of Cash Flows?

Audit of Financial Statements: Guide for Business Owners Running a business means keeping track of…

Demos

Demos  Colors

Colors  Docs

Docs  Support

Support