| Getting your Trinity Audio player ready... |

CFA vs CFO: The Real Difference Startups & Business Owners Should Know

In the dynamic world of finance, two prominent titles often surface: Chartered Financial Analyst (CFA) and Chief Financial Officer (CFO). While both play pivotal roles in the financial landscape, they serve distinct functions. This guide delves deep into the nuances of each, helping you understand their differences, career paths, and how they contribute to the financial ecosystem.

What Is a Chartered Financial Analyst (CFA)?

A Chartered Financial Analyst (CFA) is a globally recognized professional designation awarded by the CFA Institute. CFAs specialize in investment management, financial analysis, and portfolio management. The CFA credential is esteemed for its rigorous curriculum and is often pursued by individuals aiming for careers in asset management, equity research, and financial advisory services.

The Basics of Becoming a Chartered Financial Analyst (CFA)

Embarking on the CFA journey requires dedication and a clear understanding of the prerequisites and examination process.

Requirements

To enroll in the CFA Program, candidates must:

- Educational Background: Possess a bachelor’s degree or be in the final year of their undergraduate studies. Alternatively, a combination of 4,000 hours of professional work experience and/or higher education acquired over at least three consecutive years is acceptable.

- Professional Experience: Accumulate 4,000 hours of relevant professional work experience, completed in a minimum of three years, before, during, or after participation in the CFA Program.

- Membership: Become a member of the CFA Institute and adhere to the CFA Institute Code of Ethics and Standards of Professional Conduct.

Exams

The CFA Program comprises three sequential exams, each testing a candidate’s knowledge and skills in investment management.

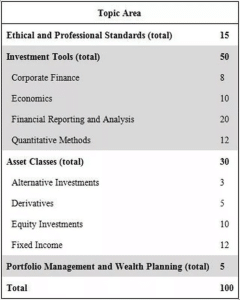

Level I Exam

- Focus: Tools and concepts that apply to investment valuation and portfolio management.

- Format: 180 multiple-choice questions divided into two 135-minute sessions.

Topics: Ethical and Professional Standards, Quantitative Methods, Economics, Financial Reporting and Analysis, Corporate Finance, Equity Investments, Fixed Income, Derivatives, Alternative Investments, Portfolio Management.

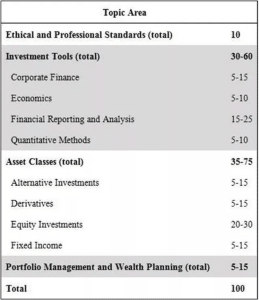

Level II Exam

- Focus: Asset valuation, emphasizing the application of investment tools and concepts in context.

- Format: 88 multiple-choice questions organized into item sets (vignettes).

- Topics: Similar to Level I but with a deeper emphasis on asset valuation and industry and company analysis.

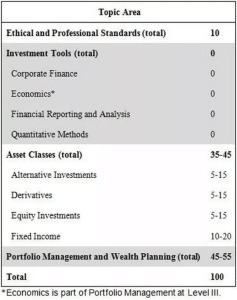

Level III Exam

- Focus: Portfolio management and wealth planning, integrating all concepts and analytical methods in a practical context.

- Format: Constructed response (essay) questions and item set questions.

- Topics: Emphasis on portfolio management and wealth planning, with continued coverage of ethics and professional standards.

Challenges of Achieving the CFA Charter

Attaining the CFA designation is a formidable endeavor. Candidates often face:

- Time Commitment: Each level requires approximately 300 hours of study, totaling around 900 hours.

- Pass Rates: Historically, pass rates hover around 40-50% for each level, reflecting the program’s rigor.

- Work-Life Balance: Balancing study with professional and personal responsibilities can be challenging.

How Long Does It Take To Pass the CFA Exams?

The duration varies based on individual circumstances. On average, candidates take about four years to complete all three levels, considering study time, exam scheduling, and potential retakes.

How Much Do the CFA Exams Cost?

As of 2025, the cost structure is:

- Enrollment Fee: A one-time fee of $350 upon entering the program.

- Exam Fees: Vary based on registration timeframes:

- Early Registration: Approximately $940 per exam.

- Standard Registration: Approximately $1,250 per exam.

- Total Estimated Cost: Ranges from $3,170 to $4,100, excluding study materials and potential retake fees.

Are the CFA Exams Multiple Choice?

- Level I: Entirely multiple-choice questions.

- Level II: Multiple-choice questions within item sets (vignettes).

- Level III: Combination of essay-style (constructed response) questions and item set multiple-choice questions.

Are CFA Charter Holders Paid More?

CFA charterholders often command higher salaries due to their specialized skills and knowledge. Compensation varies based on role, experience, and location. Positions in investment banking, portfolio management, and equity research typically offer competitive remuneration for CFA charterholders.

What Is a Chief Financial Officer (CFO)?

A Chief Financial Officer (CFO) is a senior executive responsible for managing a company’s financial actions. Their duties encompass financial planning, risk management, record-keeping, and financial reporting. CFOs play a crucial role in strategic decision-making and ensuring the company’s financial health.

Role and Responsibilities of Chief Financial Officers (CFOs)

CFOs have a broad spectrum of responsibilities, including:

- Financial Strategy: Developing and implementing financial strategies aligned with company goals.

- Budgeting and Forecasting: Overseeing budgeting processes and financial forecasting to guide business decisions.

- Risk Management: Identifying financial risks and implementing measures to mitigate them.

- Compliance and Reporting: Ensuring compliance with financial regulations and accurate financial reporting.

- Investor Relations: Communicating with shareholders and potential investors about the company’s financial performance.

Regulations and Compliance for CFOs

CFOs must navigate a complex regulatory landscape, ensuring adherence to:

- Financial Reporting Standards: Such as GAAP or IFRS.

- Tax Laws: Compliance with local and international tax regulations.

- Corporate Governance: Upholding ethical standards and transparency in financial disclosures.

Is a CFO an Accountant?

While CFOs often have backgrounds in accounting, their role extends beyond traditional accounting functions. They focus on strategic financial planning, investment decisions, and guiding the company’s financial direction. Thus, while accounting knowledge is beneficial, CFOs require a broader skill set.

What Salary Do CFOs Make?

CFO salaries vary based on company size, industry, and location. In the United States:

- Small to Mid-sized Companies: CFOs may earn between $150,000 to $300,000 annually.

- Large Corporations: Salaries can exceed $500,000, often accompanied by bonuses, stock options, and other incentives.

How Do You Become a CFO?

Becoming a CFO typically involves:

- Education: A bachelor’s degree in finance, accounting, or economics; many also hold MBAs.

- Experience: Progressive experience in financial roles, such as financial analyst, controller, or treasurer.

- Certifications: While not mandatory, certifications like CPA or CFA can enhance credibility.

- Leadership Skills: Demonstrated ability to lead teams and contribute to strategic decision-making.

Are a CFA and a CFO the Same Thing?

No, they are distinct:

- CFA: A professional designation focusing on investment analysis and portfolio management.

- CFO: A corporate executive role overseeing a company’s financial operations.

While a CFO may hold a CFA designation, the two are not synonymous.

CFA vs CFO: What is the Difference

Aspect | CFA | CFO |

Definition | Professional designation | Corporate executive role |

Focus Area | Investment analysis, portfolio management | Financial strategy, company financial health |

Pathway | Passing CFA exams, gaining relevant experience | Climbing corporate ladder in finance roles |

Responsibilities | Financial analysis, research, investment decisions | Financial planning, risk management, reporting |

Work Environment | Investment firms, banks, asset management companies | Corporations across various industries |

Certifications | CFA charterholder | May hold CPA, CFA, or MBA |

Bottom Line

Both CFAs and CFOs are integral to the financial sector but serve different purposes. A CFA is a credential for professionals specializing in investment analysis, while a CFO is a senior executive responsible for a company’s overall financial strategy. Understanding the distinctions between the two can guide career choices and organizational hiring decisions.

FAQs

Can a CFO hold a CFA designation?

Yes, many CFOs pursue the CFA designation to deepen their financial analysis skills, especially in investment-heavy industries.

Is CFA necessary to become a CFO?

No, while beneficial, a CFA is not a prerequisite for becoming a CFO. Experience, leadership skills, and a strong financial background are more critical.

Which is more challenging: Becoming a CFA or a CFO?

Both paths are challenging in different ways. The CFA requires passing rigorous exams and gaining specific experience, while becoming a CFO involves years of progressive responsibility and leadership within an organization.

Do CFAs earn more than CFOs?

Compensation varies widely. CFOs in large corporations often earn more due to their executive status, but CFAs in high-level investment roles can also command substantial salaries.

Can someone transition from a CFA role to a CFO position?

Yes, with the right experience and leadership skills, a CFA charterholder can progress into a CFO role, especially in finance-centric companies.

Related Posts

Do I Need An Accountant As A Sole Trader?

Do I Need An Accountant As A Sole Trader? Are you a sole trader running…

Fractional Finance 101: Unlocking the Power of Micro-Investing

Fractional Finance 101: Unlocking the Power of Micro-Investing Have you ever looked at the price…

Cash or Accrual Accounting: Which One Should You Use?

Cash or Accrual Accounting: Which One Should You Use? Many businesses have a choice between…

Top Accounting System Implementer – QuickBooks & More

Top Accounting System Implementer – QuickBooks & More Choosing the right accounting software is one…

Demos

Demos  Colors

Colors  Docs

Docs  Support

Support